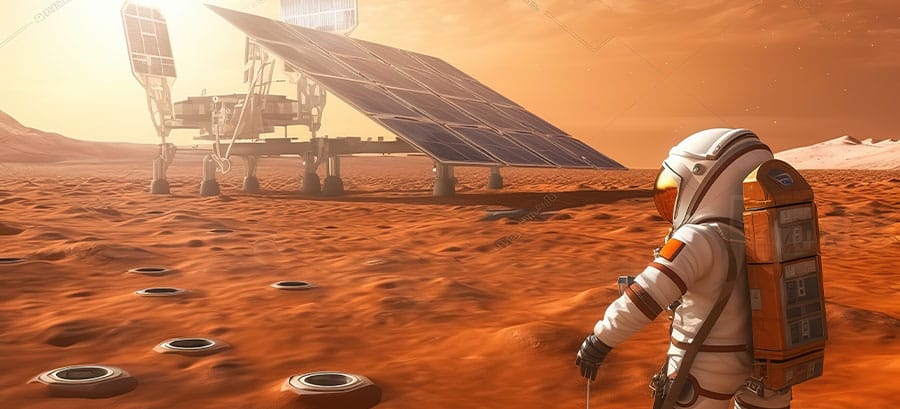

Global access, business growth, and diverse trade opportunities for cleantech companies

At Global Cleantech Directory, we make it simple for clean technology businesses to showcase their solutions, connect with the right partners, and access real opportunities for growth. Built in Canada and open to the world, our platform supports global trade, inclusive innovation, and diverse market access for cleantech companies of all sizes. Whether you're focused on solar energy, water solutions, sustainable agriculture, or green infrastructure, we help your business gain visibility, attract investment, and expand across borders. Everything is designed to be easy to use, accessible from anywhere, and focused on what matters most: helping the cleantech sector move forward through trusted connections and real-world results.

Do It Globally

Plan To Business Internationally

World Environment Day 2025 Podcast

By Shohreh Sabaghpour

Host: Hello and welcome – introduce yourself and the purpose of this conversation

Hello dear friends, and happy World Environment Day to all of you who care about our planet! Whether you’re an environmental advocate, an innovator, or someone passionate about sustainability, you’re exactly where you need to be. I’m Shohreh Sabaghpour, based in Richmond Hill, Canada. I’m a serial greenpreneur and the founder of the Global Cleantech Directory.

I studied computer engineering in Iran and have always worked to combine my technical knowledge with my passion for protecting the environment. My goal is to create peace by building harmony between humans, technology, and nature.

The idea for the Global Cleantech Directory came during the pandemic, when trade shows stopped. I realized how important it was to create a borderless platform—one that breaks through time zones and physical limits to connect cleantech businesses across the globe.

And before we begin, I want to thank Nadi and VisiontoLine magazine for making this podcast possible.

Host: What is the Global Cleantech Directory, and who is it for?

The Global Cleantech Directory is more than just a listing site. It’s a global virtual exhibition space that connects cleantech companies—startups, SMEs, and even large firms—with each other and with new opportunities.

Each company has its own dedicated page where they can display their logo, share videos, highlight services, upload brochures, and add event or campaign announcements. It’s interactive and personalized. Visitors can contact the company directly through a lead form, and companies can track how many viewers and clicks they’ve had.

It’s a powerful tool designed to give businesses more visibility and more meaningful engagement in a world where tariffs, trade limitations, and regional challenges make it harder to connect. Our platform makes global trade more accessible, inclusive, and flexible for cleantech businesses of all sizes.

Host: What makes Global Cleantech Directory different from other directories?

Unlike traditional directories that just list names alphabetically, we offer rich company profiles and make it easy to filter by region, category, and subcategory. This means you’re not just browsing — you’re discovering companies that are actually relevant to you.

We’re also a community. Only signed-in members can leave reviews, and listings must be approved before they go live. It’s built with care and quality in mind.

Think of it like a global virtual trade show—open 24/7. Businesses can showcase what makes them unique, and viewers from anywhere in the world can find and connect with them instantly.

And yes, discovery is content-based. Whether you’re searching for solar startups in North America or water-focused SMEs in the Middle East, our filters help you find exactly what you’re looking for.

Host: How does the platform support international collaboration and trade?

It’s all about breaking down barriers. Our platform helps companies explore business-to-business (B2B) and business-to-government (B2G) opportunities.

For example, if a cleantech company in Egypt wants to find a market for its product in Europe, they can use the platform to search for potential collaborators, distributors, or clients in that region—and communicate directly through the lead form on their profile.

With the world facing rising tariffs and supply chain issues, it’s crucial to have a digital tool like this. It helps companies expand without being held back by borders, time zones, or in-person constraints.

Host: What are some real examples of how the platform is being used?

We’ve already seen users add upcoming events, create announcements for new product launches, and even use the system for early customer feedback.

Some companies are using the Directory like a mini CRM — they check viewer stats, track interest, and update their listings regularly. Others are focused on community building, using our review system to build trust and social proof.

Startups love it because it’s affordable, and they can quickly test their visibility with a free 3-month trial. Larger companies love the ability to customize their profiles and campaigns.

Host: What features are you working on next?

Right now, we’re working on something really exciting: a multilingual AI-powered assistant that will be dedicated to each company.

This assistant will include voice, emotional intelligence, and language support so companies can better guide visitors — whether they’re speaking English, French, Arabic, Spanish, or Farsi. It will act like a 24/7 virtual team member helping answer questions, share materials, and improve communication.

Of course, we’re also continuing to enhance the advanced filters — by region, category, and subcategory — so if someone’s looking for cleantech startups in Asia’s energy sector, they can find exactly that. It’s all about making discovery easier and helping both buyers and sellers make meaningful connections.

Host: What has helped you move this platform forward?

One of the biggest boosts came through our partnership with OCAD University and the City of Richmond Hill, through the CLIC program — the Centre for Local Innovation and Collaboration. It’s funded by eCampus Ontario and helped us apply human-centered design to refine the user experience of our platform. That support really helped shape what you see today.

We also applied to the IPON program — because what we’re building is IP-based and scalable, and IPON supports innovation through mentorship, funding, and ecosystem connection.

These partnerships increased our credibility, helped shape our vision, and gave us the confidence to move from idea to action.

Host: Final thoughts — what would you like to ask of your listeners today?

First, I want to thank VisiontoLine and all of you who stayed with us until the end of this conversation. On this World Environment Day — June 5, 2025 — let’s take action together.

Because it’s June 5th, I invite you to share this podcast or article with at least five people in your network — especially those who care about climate action, sustainability, and innovation. Let’s make the ripple effect real and wide.

And if you haven’t already, I warmly welcome you to try the Global Cleantech Directory. No payment. No credit card. Just a 3-month free trial to explore how this platform can support your business goals and global connections.

Let’s celebrate World Environment Day not just with words — but with bold actions that support a cleaner, more connected future.

Built to Grow, Designed to Lead, Powered by AI and Grounded in Humanity

At the Global Cleantech Directory, innovation isn’t just a value—it’s our growth engine. Through our dedicated Innovation Lab, we’re actively developing AI-powered solutions that help cleantech businesses grow smarter, connect globally, and operate with greater purpose. We understand that clean technology must evolve with the world’s most urgent challenges. That’s why we’re focused on building intelligent, human-centered systems that support both sustainability and meaningful progress—at scale. Our approach blends advanced digital tools with a deep commitment to accessibility, inclusion, and impact. Every step forward is designed not only to support businesses—but to serve people and the planet. Innovation at Global Cleantech Directory means building what’s next—today. Driven by purpose. Informed by data. Delivered through AI and Aligned with humanity

WHY JOIN US

Global access

Your cleantech business can be discovered by international partners, investors, and customers

Business growth

We offer the tools, support, and exposure to help you scale with confidence

Diverse trade opportunities

Connect with markets and sectors across borders and industries

Global multi-continent visibility

Businesses can list across multiple continents, increasing exposure and reach—ideal for franchises and international companies

Authentic, member-only reviews

Only signed-in members can submit reviews, helping build trust and protect the quality of community feedback

All-in-one business tools

From event creation and ad campaigns to appointment scheduling and lead forms, the platform provides everything needed to grow, promote, and connect

Uniting for a Sustainable Future

What is the Global Cleantech Directory?

- This guide will introduce some important steps to successfully work with Global Cleantech Business Directory. All the upcoming sections will give you details on how to add listings and some of the main features available, giving a step by step guide to understanding the structure and how things work underneath the core system of this Directory

Global CleanTech Directory Categories

Categories in a clean tech directory enhance search efficiency by organizing information into specific, relevant sections. This structure allows users to quickly locate the exact topics or solutions they need. By providing a clear framework, categories streamline the search process, improve accuracy, ultimately helping users find and implement clean technology solutions more effectively.

How Does This Work?

Blog & News